What Are Cash Purchases? Recording, Benefits & Drawbacks

The sales price is a cash inflow in the investing section of the cash flow statement, which is pretty straightforward. The gain appears as a negative amount in the operating section, and the reason for this is a little more complicated. For clarity, the context of “sale” in this section refers to the disposal of equipment, not the sale of equipment as part of the ordinary course of business. If you sell equipment as your main line of business, all cash flows from those sales go to the operating activities section of the cash flow statement. When a company acquires a plant asset, accountants record the asset at the cost of acquisition (historical cost). When a plant asset is purchased for cash, its acquisition cost is simply the agreed on cash price.

What is the Cash Payment Journal? Example, Journal Entries, and Explained

The amount of insurance premiums that have not yet expired should be reported in the current asset account Prepaid Insurance. With larger, exchange-listed companies, the expenses portion may be broken down into more-specific subcategories. The aggregate of all cash purchases and other cash outflows is instead part of the figures listed in the expenses portion. The effect of the purchase of equipment on the cash flow statement depends on whether cash was involved in the purchase.

How does the sale of equipment affect cash flow?

Consulting with a small business banking representative from Community Bank can provide further insights into which choice makes the most sense given the company’s goals and circumstances. Fixed assets provide companies with benefits beyond their initial value. These assets are reflected in the noncurrent asset section of the balance sheet and are often analyzed by investors when valuing a company. The journal entry should also include the date of purchase and the vendor’s name. This information helps to identify the vendor and the amount of the purchase.

What is the interest rate on an equipment loan?

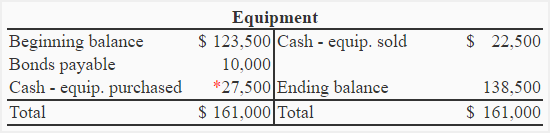

When you first buy new, long-term equipment (i.e., fixed assets), it doesn’t go on your income statement right away. Instead, record an asset purchase entry on your business balance sheet and cash flow statement. The journal entry is used to record the purchase of the fixed asset and the payment terms how to calculate profit margin that have been agreed upon with the vendor. The amount of the purchase will be debited to the Equipment fixed assets account, while the Accounts Payable account will be credited with the amount of the purchase. This reflects the company’s obligation to pay the vendor in the future for the purchase.

- These resources are necessary for the companies to operate and ultimately make a profit.

- In short, equipment is an essential part of any business and should be given careful consideration before any major decisions are made.

- Using the straight-line method of depreciation, each year’s profit and loss statement will report depreciation expense of $10,000 for 10 years.

- And, record new equipment on your company’s cash flow statement in the investments section.

Before we dive into how to create each kind of fixed asset journal entry, brush up on debits and credits. There are no transactions related to the cash yet at the time of purchase for the credit purchase. The company will require to record the fixed assets when risk and rewards transfer from the sellers. The company expects to generate future economic benefits from the fixed assets and it expects to last for more than a year. The proceeds of the bank loan are not considered to be revenue since ASC did not earn the money by providing services, investing, etc. As a result, there is no income statement effect from this transaction.

Accounting Equation Outline

While convenient, credit cards come with higher interest rates than traditional loans. Ultimately, you have control over your cashflow while focusing on your business growth. Since you’ve paid in full, you may be left without much financial safety net to resolve this situation.

As you can see, the two important accounts that affect at the time of purchasing are account payable (maybe the supplier’s account) and office supplies expenses, assets items, or expenses. The following are the accounting records for both purchases on credit and cash purchases. Overall, fixed assets can provide companies with value beyond just the initial cost of the asset. This is because the purchase is an increase to the fixed asset value, and the account payable is used to track the debt that the company has with an outside vendor.

A cash purchase is the immediate exchange of goods or services for money without the involvement of credit or loans. Predominantly means that the machinery or equipment is used more than 50% of the time in a production activity. Equipment financing is certainly an excellent loan option for businesses.

As it is a credit purchase, it will record the accounts payable as well. Purchase on credit If you buy something, but don’t pay for it right away. The company will settle balance based on the credit term that the supplier provides.

All of these purchasing needs to records in the entity’s accounting system so that management could have the proper reports about its expenses and for management purposes. With our streamlined process, you can receive funding quickly, often within 48 hours, allowing you to seize opportunities without delay. Trust us to provide transparent and ethical financing options that align with your growth. Explore our revenue-based financing option today to fund the right equipment that will empower your business for long-term success.

Conversely, when you finance the truck, cash becomes available to handle expenses and unexpected circumstances. However, if you need funding for other business expenses, you must explore alternative loan types with your preferred lender. Equipment financing is only useful for purchasing or repairing business tools. If you boast a high credit score, you can expect to secure a lower rate, potentially saving you hundreds or even thousands of dollars over the life of the loan. The interest rate on an equipment loan typically ranges from 7% to 20%. Therefore, compare lenders to find the best financing options, interest rates, and repayment terms that suit your budget.

We’ve been working with Optiweb Marketing for 2 years now, all i can say is that they are the best of the best… Their response time is incredibly fast, their attention to details differentiate them from the rest of the competitors. Thank you for the great service you provided to all our clients.

OptiWeb Marketing designed an attractive website for us. The project was done at very reasonable price, especially if you take the quality into consideration. Our experience with OptiWeb Marketing went really well and got better as the project progressed. They gave us excellent advice. This is definitely not our last project with OptiWeb Marketing. I would like to say one last thing. I have also started to use their SEO services (for a few months) and I would like to thank the OptiWeb Marketing team for their outstanding commitment to my project at a very reasonable.

The Optiweb team go above and beyond to make sure that you have the website that you envisioned. Having worked with other companies in the past, I was amazed at how painless our experience with Optiweb was. I highly recommend them!.

Thank you Brad and his team on a wonderful job in redesigning our company website. The experience was stress free and they were very receptive to my changes. Great work and great experience. Thank you.

I was referred to OptiWeb Marketing by a friend of mine. I was looking to redesign my website at an affordable price. They came up with a very attractive design that I immediately liked. Once we had the platform, they worked diligently to get the website up and running asap. Throughout the process, they kept in constant communication to ensure a high level of quality and service. I was very impressed and would recommend them to anyone looking to redesign their website.

Thank you so so much for all the work you did with our website! All the back and forth was so appreciated. It was so easy working with your team! I would highly, highly recommend Optiweb Marketing!

OptiWeb is the most talented web design and development team I’ve ever had the pleasure of working with. From day one they keep you in the loop about everything and truly go above and beyond. Highly recommend.

Brad, I can’t thank you and your team enough for all your work and dedication to my website! I’m so impressed with the care you took and speed at completing all the tasks. I really appreciate everything that you did and look forward to working with you again! I highly recommend you and your team for web services.

growth

insider

5 Effective Strategies to Instantly Lower Your Cost per Click (CPC) in 2025

read on the blog

Importance of SEO Services for Businesses in Montreal

read on the blog

Summary of Shopify Editions – Summer 2024

read on the blog

A Comprehensive Mobile App Marketing Guide

read on the blog

What is an SSL certificate and what is it used for? Hosting

read on the blogour digital

toolkit